In the realm of modern finance, where digital solutions are becoming increasingly dominant, businesses are seeking more efficient ways to manage their financial operations. One notable development in this landscape is the emergence of business accounts with IBAN, offered by E-Money Institutions (EMIs). These institutions have introduced a new dimension to business banking by providing dedicated IBAN accounts that facilitate seamless domestic and international transactions.

Understanding the Role of E-Money Institutions

E-Money Institutions (EMIs) have gained prominence as financial entities that offer electronic payment services and electronic money issuance. They are licensed to operate across various jurisdictions and provide businesses with an alternative to traditional banking services. One of the notable services offered by EMIs is business accounts with International Bank Account Number (IBAN) capabilities.

The Significance of Dedicated IBAN Accounts

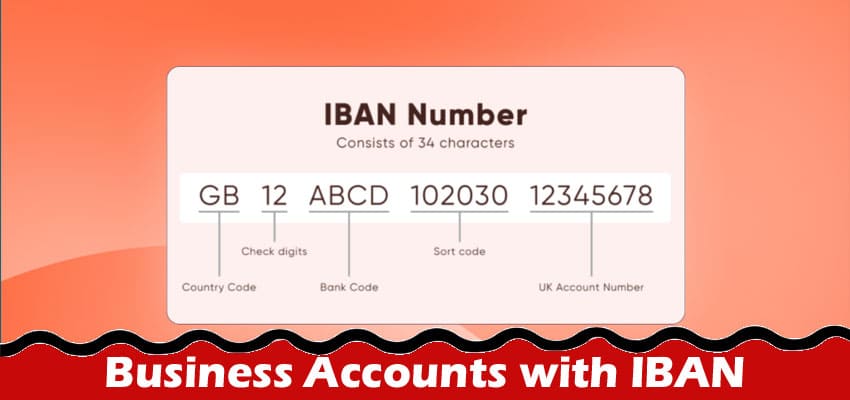

A dedicated IBAN account is a fundamental feature offered by E-Money Institutions to businesses. An IBAN is a standardized numerical code that is used to identify bank accounts in cross-border transactions. By providing businesses with dedicated IBAN accounts, EMIs enable them to conduct transactions more smoothly and efficiently.

Facilitating Cross-Border Transactions

Businesses engaged in international trade and commerce often face challenges when it comes to cross-border transactions. Fluctuating exchange rates, high transaction fees, and lengthy processing times are some of the hurdles that businesses encounter. However, with dedicated IBAN accounts offered by EMIs, these challenges can be mitigated. Businesses can receive and send payments in multiple currencies, making cross-border transactions faster and more cost-effective.

Simplifying Payment Processing

Payment processing is a critical aspect of any business operation. EMIs offering business accounts with IBAN provide a streamlined solution for payment processing. With a dedicated IBAN account, businesses can receive payments from clients and customers with ease. Moreover, they can set up automatic payment routing, which simplifies the distribution of funds to various stakeholders such as suppliers, employees, and partners.

Enhanced Financial Management

Managing finances is essential for the success of any business. E-Money Institutions recognize this need and provide businesses with tools to enhance their financial management. Dedicated IBAN accounts often come with user-friendly online platforms that allow businesses to monitor their transactions in real-time. This visibility into financial activities empowers businesses to make informed decisions and optimize their cash flow.

Integration of SEPA Instant Payment

In the realm of digital payments, SEPA Instant Payment has garnered attention for its efficiency and speed. This payment method allows for instant transfers between accounts located within the Single Euro Payments Area (SEPA). E-Money Institutions have integrated SEPA Instant Payment capabilities into their services, allowing businesses to leverage the benefits of instantaneous fund transfers. This integration enhances the overall transaction experience and aligns with the evolving pace of modern business operations.

Risk Mitigation and Security Measures

Security is a paramount concern in financial transactions, especially for businesses. E-Money Institutions offering dedicated IBAN accounts prioritize security by implementing robust encryption protocols and authentication measures. Additionally, these institutions adhere to regulatory frameworks that safeguard customer funds and personal information. By partnering with EMIs, businesses can enjoy the benefits of efficient transactions without compromising on security.

Accessibility and Inclusivity

One of the notable advantages of E-Money Institutions is their accessibility and inclusivity. Traditional banking services may have stringent eligibility criteria, making it challenging for certain businesses to access the financial tools they need. EMIs, on the other hand, often have more flexible requirements, making their services accessible to a wider range of businesses. This inclusivity fosters economic growth and empowers small and medium enterprises to thrive.

The Future Landscape

As businesses continue to embrace digital solutions for their financial operations, the role of E-Money Institutions and their dedicated IBAN accounts is poised to expand. The integration of innovative technologies such as blockchain and artificial intelligence may further enhance the capabilities of these institutions, offering businesses even more efficient and secure financial management tools.

In conclusion, the introduction of business accounts with IBAN by E-Money Institutions has revolutionized the way businesses manage their financial transactions. These dedicated IBAN accounts streamline cross-border transactions, simplify payment processing, and enhance financial management. With the integration of SEPA Instant Payment and a strong focus on security, businesses can confidently leverage the services offered by EMIs to drive growth and success in the digital age.