Insurance can be complex, but it needn’t be. Insurancey, the one-stop location for comparing auto quotes, analyzes all of the leading insurance providers in one area so that you can compare rates and safeguard your vehicle, house, and other belongings.

I have used auto insurance, which has helped me save huge amounts of cash. This was how I avoided overspending on lavish vehicle insurance policies. My auto insurance quote service provider helped me find different insurers offering the desired coverage at a budget-friendly rate.

However, without delay, let’s get started with the best auto insurance quote comparison site, The Insurancey!

What You Should Know About Insurancey

By delivering customized insurance quotes from major firms, Insurancey, an individual insurance counselor and comparison website, can speed up your search for data.

Making it simple and fast for you to evaluate quotes online helps eliminate the uncertainty of deciding which insurance companies will be appropriate for you. They collaborate with big and small businesses to assist you in locating coverage that meets your requirements.

Insurancey allows you to:

- Compare car insurance quotes for free

- Save time by receiving several quotations at once.

- Identify the lowest auto insurance providers depending on your driving history.

- Find out which insurance suits your requirements the best.

- Consult the trained internal staff for assistance.

- You may rest easy knowing that your private data is secure.

Insurancey greatly values your confidentiality; you won’t get any spam, and your data will never be sold. To get started, go online or talk to a representative. Most of the nation’s largest insurers have designated their own organization to market insurance on their behalf. You can learn more about all-wheel drive by visiting Insurancey.

Pros & Cons of Insurancey

Before comparing auto insurance quotes for free with the help of Insurancey, these are the leading pros and cons shown below:

Pros

- It demonstrates valid quotes in real-time.

- It collaborates with substantial regional and national firms.

- It helps safeguard your data so unsolicited phone calls can’t trouble you.

- It provides a faster sign-up process.

- You will get a real-time option to talk to an agent.

- You can obtain several auto insurance quotes in a single location.

- It offers a smooth user interface.

Cons

- Customers begin receiving many phone calls and messages shortly after signing up.

- No mobile application exists for this utility.

The procedure of comparing quotes in Insurancey

The easiest way to view customized prices and coverage choices from insurance providers is to request quotes for auto insurance. While typical auto insurance providers provide free consultations, the procedure might be ineffective because there is only one outcome.

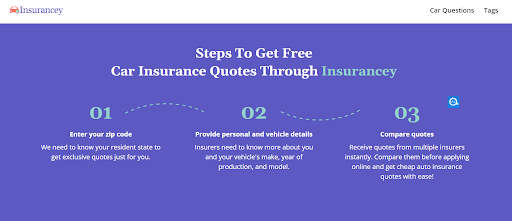

Drivers may submit a few pieces of elementary information on Insurancey, and in a matter of minutes, you will start getting quotations from hundreds of the most reliable insurance providers. You may compare vehicle insurance quotes online at Insurancey by following these precise steps:

Step 1: Visit the official website of Insurancey.

Step 2: Provide your ZIP code in the “Enter Your ZIP Code” area, and hit the “Get Quotes” option.

Step 3: Submit personal and car details as the insurers require more details about you and the vehicles you operate, including the manufacturing year, brand, and model.

Step 4: Once done, you will quickly start receiving quotes from several insurers. It would be best to compare those auto insurance quotes before applying online to easily obtain meager quotes.

Every auto insurance quote presented in front of you will be fully customized and depend on your needs. As vehicle insurance firms have complex algorithms to estimate and ascertain the insurance charges, the auto insurance price will differ because of your age, driving history, and vehicle type.

The Insurancey’s Pricing

Insurancey provides free quote comparison services to their users. With Insurancey, you can save up to $670 a year, or $54 a month, which is a sizable amount. After completion, you’ll have a wide range of alternatives, which takes a few minutes.

You may also see your quotation from the website or the straightforward email you obtain as soon as it is finished if you aren’t ready to purchase immediately. Insurancey will automatically update your costing when you visit due to the frequent price fluctuations.

Additionally, none of this will include any spam. Instead of collecting money from the users, Insurancey collects its funding from the insurance companies.

The Insurancey’s Services

- Customized quotes

The opportunity to personalize your estimate from functionalized insurance programs of “Low,” “Basic,” “Advanced,” and “Ultimate” is among the most popular services offered by Insurancey. It also enables you to obtain a more precise quote that meets your requirements. However, it also instructs customers where and how to hunt for the most advantageous discounts.

- Free of spam

Insurancey’s assurance of straightforward savings without spam is another major selling point. Your email address or phone number may be sent to each supplier by some quotation comparison websites, allowing them to contact you for follow-up. It is risk-free if you agree not to send unsolicited texts or emails.

The Insurancey’s Offering

The platform’s independence and objectivity are of utmost importance to the Insurancey offering. They don’t offer insurance and have no loyalty to any business partners they collaborate with. Instead, they collaborate with well-known companies that offer vehicle insurance and uphold the same standard of expertise.

It is fantastic because they present a wide range of actual costs at the end of the operation, rather than a list of prospective insurance providers. Although those costs could alter if you shift the available options, they serve as a helpful preliminary step for closing the purchase.

The Insurancey’s limitation

There is a limitation on the number of functionalized policy modifications you may apply (e.g., minimal, basic, improved, excellent). And the price you ultimately pay for a replacement insurance policy will be influenced by those particulars.

However, personally dealing with a certain insurance company is necessary for those specifics. Consequently, based on the company you select, there is still some chance for irritation until you receive a fresh policy.

The bottom line

Insurancey does not sell insurance. To aid customers in making better insurance selections, it offers tools that have been vetted by experts and supported by statistics.

Additionally, the automobile insurance prices published on Insurancey’s web pages are based on a thorough assessment of car insurance pricing information, analyzing over 83 million insurance prices throughout the United States. Its insurance material is documented and assessed for precision by certified insurance brokers.